Recently, we’ve seen that Samsung Galaxy S25 sales are breaking old Android trends. Instead of demand decreasing after launch, it’s actually increasing again mid-cycle, signaling a major shift in Samsung’s flagship strategy.

This clearly indicates that something unusual is happening with the Samsung Galaxy S25 series. Typically, Android flagship sales follow a predictable pattern. But this time, Samsung seems to be rewriting the rules.

So, in this article, let’s understand what this surprising sales curve actually means and why it’s so important for the future of flagship smartphones.

Galaxy S25 Sales Pattern Breaks Android Tradition

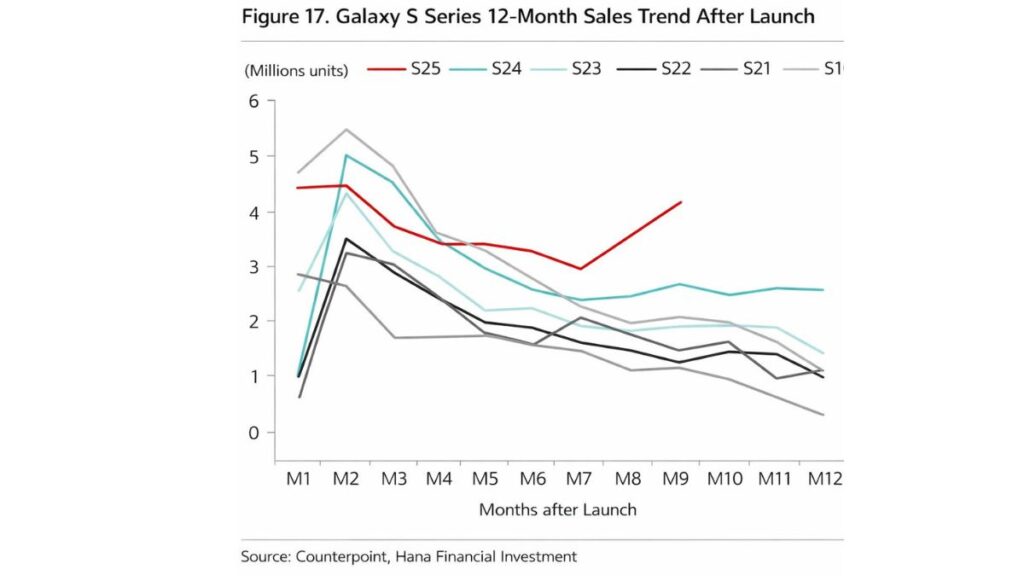

It’s commonly observed that Android flagship phones experience a rapid surge in sales immediately after launch. This peak typically lasts for two or three months, after which demand gradually declines. In fact, this pattern has held true for most Galaxy S models over the years, including the S22, S23, and S24.

However, the story of the Samsung Galaxy S25 is quite different. While sales initially followed the expected pattern of a post-launch surge followed by a decline, they unexpectedly rebounded around the eighth and ninth months. Consequently, this mid-cycle recovery is a highly unusual occurrence in the Android ecosystem.

Meanwhile, historical sales data shows that such a recovery almost never happens organically. Therefore, the red line on the sales chart warrants serious attention, especially for those tracking smartphone market trends.

Why the Galaxy S25 Mid-Cycle Sales Rebound Matters

It’s worth noting that, at first glance, some might assume this recovery reflects delayed consumer upgrades. However, this explanation is flawed, as users rarely decide to purchase flagship phones en masse eight or nine months after launch.

Instead, this recovery points to a structural shift. For example, Samsung may have implemented significant price cuts, offered better incentives to carriers, or secured large enterprise orders.

Furthermore, Samsung itself might be deliberately extending the product lifecycle through strategic market interventions.

Therefore, the Galaxy S25 isn’t behaving like a typical Android flagship. Rather, it’s being positioned as a long-term, year-round product instead of a short-lived, hype-driven release. What do you think could be the reason behind this trend? Share your thoughts in the comments below.

Samsung’s Strategic Shift Toward a Longer Flagship Lifecycle

What’s interesting about Samsung’s strategy is that this sales behavior closely resembles Apple’s well-known iPhone strategy. Apple treats its flagship model as a core product throughout the year, consistently supporting it through pricing, marketing, and availability.

Similarly, Samsung now appears to be adopting the same approach with the Galaxy S25. Furthermore, this shift suggests that Samsung aims to stabilize flagship revenue rather than relying solely on massive sales spikes at launch.

As a result, the Galaxy S25 now feels less like a fast-selling Android device and more like a long-lasting premium product. This change could redefine how future Galaxy S models are launched, priced, and supported.

Is Organic Demand Enough for the Galaxy S25?

On the other hand, we must also consider an important point. Looking at the pricing and operational support, it becomes clear that organic demand alone might not be strong enough to maintain momentum.

In other words, while the sales curve looks promising, it may largely depend on Samsung’s internal efforts. However, this doesn’t necessarily indicate any weakness. Rather, it demonstrates a controlled and strategic approach to sales management on Samsung’s part.

Therefore, instead of letting sales drop after the initial hype, Samsung is actively smoothing the curve. And this is precisely Samsung’s approach that mitigates the fluctuations in Galaxy S sales and ensures a consistent market presence throughout the year.

How the Galaxy S25 Compares to Previous Galaxy S Models

When compared to the Galaxy S22 and S23, the difference is striking. Both earlier models saw sharp declines in the second half of their lifecycle. Meanwhile, the Galaxy S25 avoids that collapse entirely.

Additionally, the S25’s rebound phase signals improved resilience. As a result, Samsung gains more flexibility in inventory management, marketing timing, and global distribution.

Ultimately, this makes the Galaxy S25 one of the most interesting flagship sales cases Samsung has produced in years.

Galaxy S25 Sales Curve Key Takeaways

| Aspect | Observation |

|---|---|

| Launch Phase | Strong early sales peak similar to past Galaxy S models |

| Mid-Cycle Performance | Unexpected rebound around months 8–9 |

| Strategy Shift | Extended lifecycle similar to iPhone-style sales management |

| Market Impact | More stable and predictable flagship performance |

What This Means for Samsung and Android Flagships

Looking ahead, this sales behavior could reshape the Android flagship market. If Samsung continues this strategy, competitors may follow. Moreover, consumers could benefit from longer software focus, better pricing windows, and extended device relevance.

Therefore, the Galaxy S25 may represent more than just a successful phone. It could mark the beginning of a new flagship sales philosophy within Android.

At the very least, that red line on the sales chart proves one thing clearly: the Galaxy S25 didn’t fade quietly. Instead, it pushed back against expectations and forced the industry to take a closer look.

Overall…

The Galaxy S25’s sales pattern signals a meaningful shift in how Android flagships may be handled going forward. Instead of burning bright and fading quickly, Samsung appears to be building a longer, more sustainable lifecycle for its premium smartphones.

At the very least, that unusual sales rebound proves one thing clearly: the Galaxy S25 did not fade quietly. Instead, it challenged long-standing expectations and forced the smartphone industry to take a closer look.

FAQs

Why did Galaxy S25 sales increase after 8 months?

Likely due to strategic pricing, carrier incentives, and lifecycle extension.

Is this sales pattern common for Android phones?

No, mid-cycle rebounds are extremely rare for Android flagships.

Does this mean Galaxy S25 demand is stronger?

It suggests controlled and healthier sales, though supported by strategy.

SEE ALSO: Samsung One UI 8.5 Beta Program Goes Live in India for Galaxy S25 Series